greenville county property tax search

Several government offices in Greenville and South Carolina state maintain Property Records which are a valuable tool for understanding the. Ad Enter Any Address Find Previous Property Owner Records for Your State.

New Construction Homes In New Jersey Toll Brothers

Get a Paid Property Tax Receipt for SCDNR Registration.

. VIN SCDOR Reference ID County File. Please make your check payable to Greenville County Tax Collector and mail to. Users of this data are hereby notified that the aforementioned public information sources should be consulted for verification of the information.

Pitt County Tax Administration 111 S. They are maintained by various government offices in Greenville County South Carolina State and at the Federal level. Personal property returns cannot be filed electronically.

Public Property Records provide information on land homes and commercial properties in Greenville including titles property deeds mortgages property tax assessment records and other documents. Search Vehicle Real Estate Other Taxes. Welcome to the Greenville County Geographic Information Systems GIS homepage.

There you can also print a copy of your tax bill if you did not receive one or it got misplaced. The City collects its own. Greenville County Tax Collector SC 301 University Ridge Suite 700 Greenville SC 29601 864-467-7050.

The State of Alabama Department of Revenue collects the Citys Sales and Use Tax. Search through Greenville County property and land records to uncover information from dozens of databases. You can pay your property tax bill at the Tax Collectors department.

Business owners have the option of remitting rental lodging and occupancy fee taxes directly to the State via One Spot or may remit payment to The City of Greenville. Up to 38 cash back Greenville County Clerk Property Records. Other fees about which we have no information about may apply.

800 AM to 500 PM Monday - Friday Except for county observed holidays. Only search using 1 of the boxes below. You can also pay online.

The Tax Administration Department exists for the listing appraisal assessment and collection of taxes on real and personal property governed by the North Carolina General Statutes for the City of Oxford City of Creedmoor Town of Butner Town of Stovall. Our mission is to provide accurate and timely geographic information system access technical assistance and related services to meet the needs of County operations. They are a valuable tool for the real estate industry offering.

Pay Your Greenville County Tax Collector SC Tax Bill Online. Tax bills or payments etc you can use the link below to the Outagamie County Property Search. All data is compiled from recorded deeds plats and other public records and data.

Below are instructions on how to use the Property. Final taxes are obtained by adding special assessment which is a flat rate levied for services like sanitation and storm water. Once you locate your property using the search methods above simply click the Add button to the left of the property to add it to.

Contact Assessing 919 693-4181 or Collections 919 693-7714 The Tax Office is located at 141 Williamsboro Street Oxford. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Tax Collector Suite 700.

Greenville County Auditor 301 University Ridge Suite 800 Greenville SC 29601. Pitt County Tax Collector PO Box 875 Greenville NC 27835 Phone. All information on this site is prepared for the inventory of real property found within Granville County.

Property Taxes W6860 Parkview Drive PO BOX 60 Greenville WI 54942. County functions supported by GIS include real estate tax assessment law enforcement. If your vehicle is improperly qualified or you are uncertain whether your vehicle would be eligible for car tax relief because it is used part of the time for business purposes contact the Greensville County Commissioner of the Revenues Office at 434-348-4227.

Village of Greenville Attn. Use the resources provided below to get more information on deed records appraiser assessor data that may be available at the county clerk or recorders office. Washington Street Greenville NC 27834 Hours of Operation.

Search For Greenville County Online Property Taxes Info From 2021. Ad One Simple Search Gets You a Comprehensive Greenville County Property Report.

Owen County Indiana Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And M Rock County West Linn Allegheny County

Pin By Blake Avery On Idaho Falls Yesteryear Street View Idaho Falls Scenes

Ultimate Guide To Understanding South Carolina Property Taxes

Arizona New Construction Homes For Sale Toll Brothers

New Construction Homes In Maryland Toll Brothers

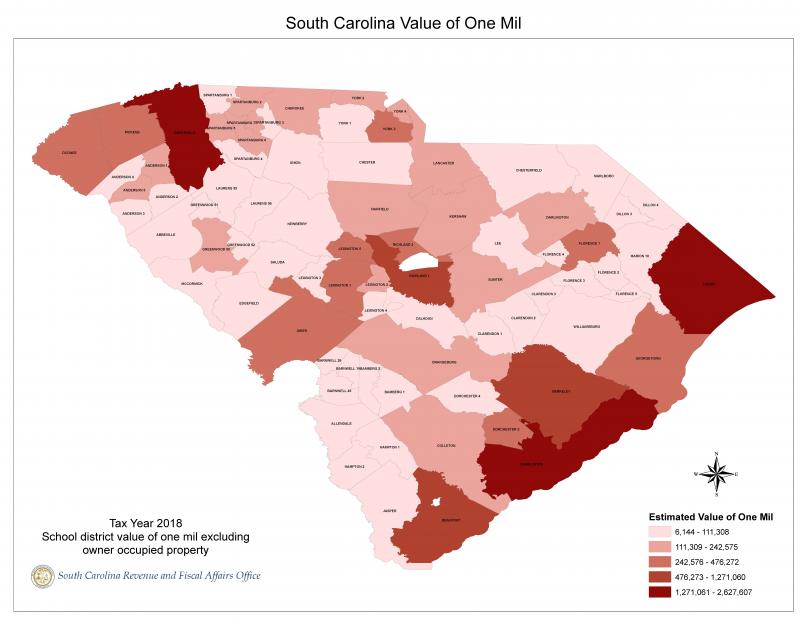

Property Tax Reports South Carolina Revenue And Fiscal Affairs Office

New Construction Homes For Sale Toll Brothers Luxury Homes

Delaware Homes For Sale New Luxury Home Communities Toll Brothers

Why Land Values Are Rising In Greenville County South Carolina

Webinar Avoiding Scams Involving Contractors Webinar Case Management Legal Services

New York Property Tax Calculator 2020 Empire Center For Public Policy

New Construction Homes In Pennsylvania Toll Brothers

Delaware Homes For Sale New Luxury Home Communities Toll Brothers